Dolar En Chile: Exchange Rates, Forecasts, And Economic Impact

Exchange rates between the Chilean peso and the US dollar are critical economic indicators in Chile, impacting various aspects of the country's economy.

With Dolar En Chile: Exchange Rates, Forecasts, And Economic Impact, we provide insights into these rates, their fluctuations, and their impact on Chile's economy.

FAQs

This FAQ section provides detailed answers to the most commonly asked questions about exchange rates, forecasts, and the economic impact of the US dollar in Chile.

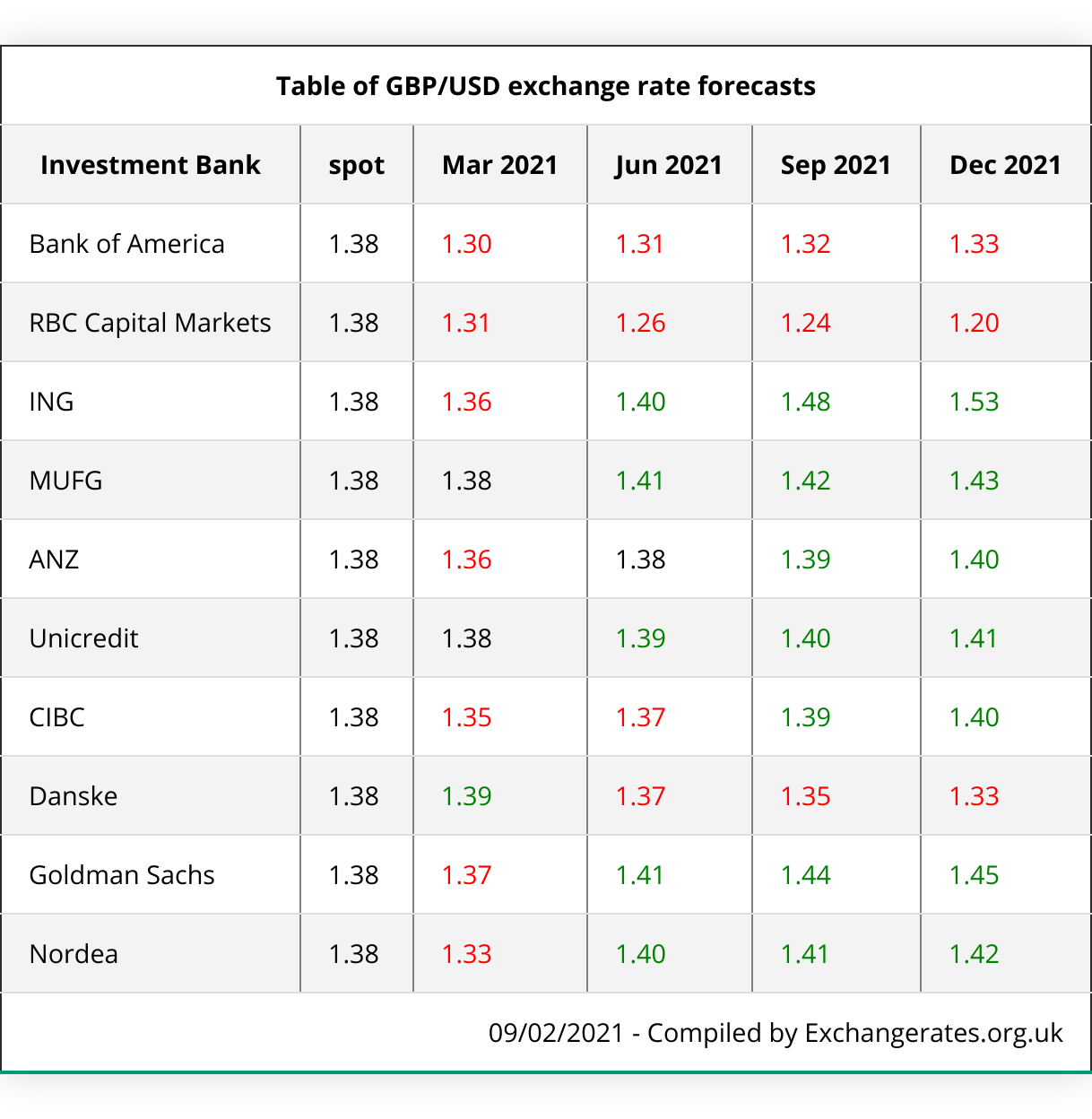

Pound To Dollar Forecasts Next 6-9 Months: 70% Of Top 10 Banks Predict - Source www.exchangerates.org.uk

Question 1: What factors influence the exchange rate between the US dollar and the Chilean peso?

The exchange rate between the US dollar and the Chilean peso is determined by a combination of fundamental economic factors, including inflation rates, interest rates, economic growth, and trade balances.

Question 2: How do exchange rate forecasts affect businesses and consumers?

Exchange rate forecasts can significantly impact businesses and consumers as they influence the cost of imports and exports, affecting corporate profits, consumer prices, and investment decisions.

Question 3: What is the economic impact of a strong US dollar on Chile?

A strong US dollar can negatively affect Chile's export sector, making Chilean goods more expensive in international markets. However, it can also benefit importers and reduce inflation by lowering the cost of imported goods.

Question 4: How does the Chilean government manage the exchange rate?

The Chilean government uses various tools to manage the exchange rate, including market interventions, interest rate adjustments, and capital controls. The Central Bank of Chile plays a crucial role in maintaining stability and mitigating excessive volatility.

Question 5: What are the historical trends and patterns of the US dollar-Chilean peso exchange rate?

Historically, the exchange rate has fluctuated significantly, influenced by global economic conditions and domestic factors. Understanding these trends and patterns can provide insights into future movements.

Question 6: How can I stay updated on the latest exchange rate information and forecasts?

To stay informed, refer to reputable sources such as financial news outlets, official government websites, and economic research institutions. Monitoring exchange rate fluctuations and forecasts enables better decision-making and risk management.

These FAQs provide a comprehensive overview of the key aspects related to exchange rates, forecasts, and their economic impact. By staying informed and understanding these factors, individuals and businesses can navigate the complexities of the foreign exchange market.

Proceed to the next section for further insights.

Tips on Monitoring Exchange Rates, Forecasts, and Economic Impact

To stay informed about the latest exchange rates, forecasts, and economic impact of the Chilean peso, consider the following tips:

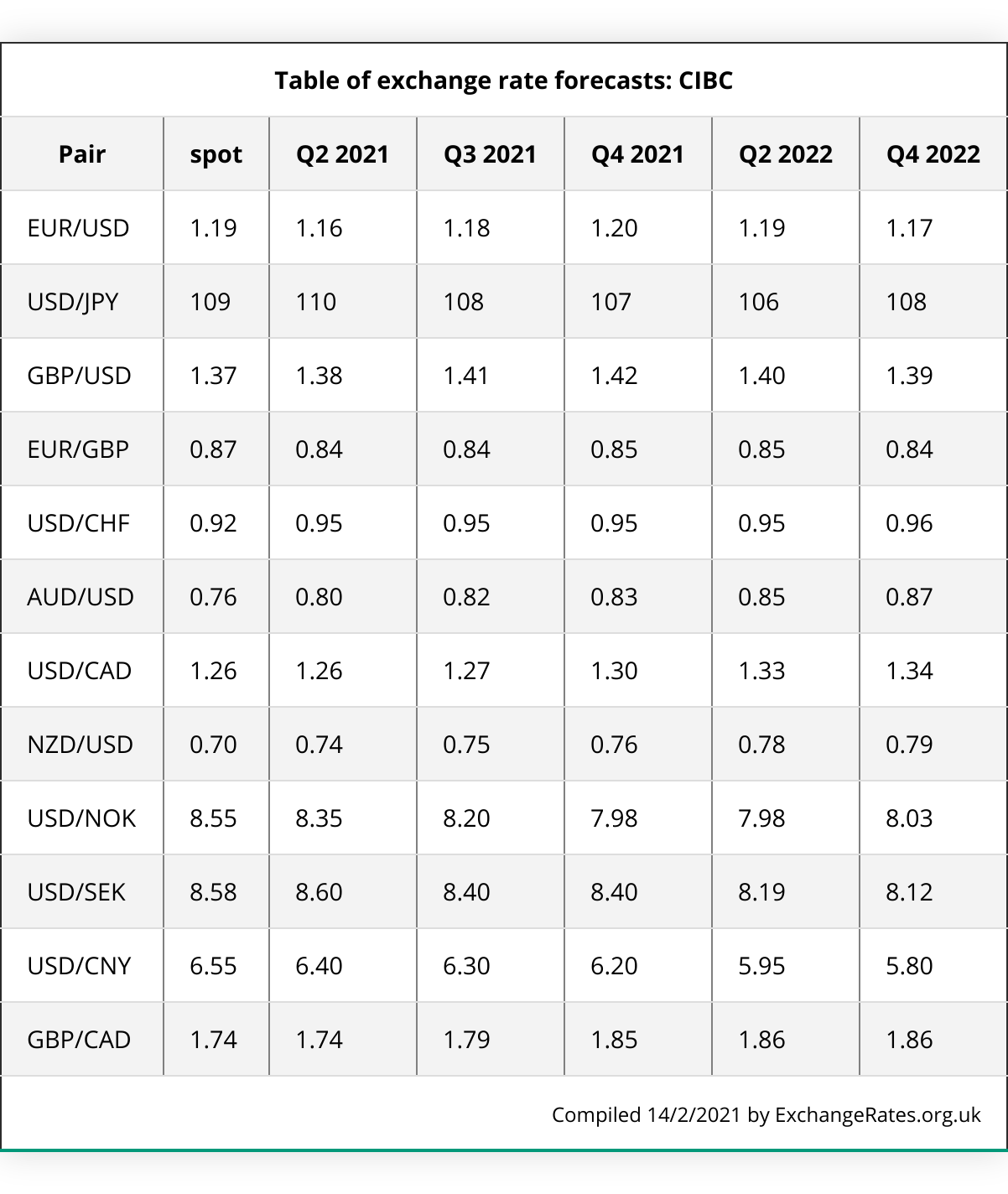

CIBC's Exchange Rate Forecasts Update For The Period 2021-2022 - Source www.exchangerates.org.uk

Tip 1: Track Currency Websites and News Sources

Stay updated with the latest currency exchange rates by visiting specialized websites and reading reputable news sources. Dolar En Chile: Exchange Rates, Forecasts, And Economic Impact provides comprehensive information on the Chilean peso, including historical data, forecasts, and analysis.

Tip 2: Monitor Central Bank Statements

Central banks play a significant role in managing exchange rates. Follow statements and announcements from the Central Bank of Chile to understand their monetary policy decisions and their potential impact on the peso.

Tip 3: Analyze Economic Indicators

Economic indicators such as inflation, interest rates, and GDP growth can influence exchange rates. Monitor these indicators to assess the overall health of the Chilean economy and its impact on the peso.

Tip 4: Consider Political Developments

Political events and uncertainties can affect exchange rates. Keep track of major political developments in Chile, including elections, policy changes, and economic sanctions.

Tip 5: Use Currency Forecast Tools

Various tools are available online that provide currency forecasts. While forecasts should be used with caution, they can offer insights into potential trends and market expectations.

Understanding exchange rates, forecasts, and economic impact is crucial for businesses, investors, and anyone involved in international transactions. By following these tips, you can stay informed and make informed decisions.

Dolar En Chile: Exchange Rates, Forecasts, And Economic Impact

The exchange rate of the US dollar (USD) to the Chilean peso (CLP) has a significant impact on the Chilean economy. Key aspects to consider include:

- Exchange rate fluctuations: Variations in the USD/CLP rate affect import and export costs.

- Economic forecasts: Predictions of future exchange rates influence business decisions and investments.

- Inflation and purchasing power: A stronger peso can reduce inflation and increase purchasing power.

- Foreign debt: Chile's external debt is denominated in USD, affecting debt servicing costs.

- Tourism and investment: A weaker peso can boost tourism and attract foreign investment.

- Central bank interventions: To manage exchange rate volatility, the Central Bank of Chile intervenes in the market.

These aspects are interconnected. Exchange rate fluctuations impact economic forecasts, which affect inflation and purchasing power. Foreign debt costs are influenced by the exchange rate, while tourism and investment can impact the overall economy. Central bank interventions aim to stabilize the exchange rate and mitigate economic volatility. Understanding these relationships is crucial for businesses, policymakers, and individuals.

Economic Recovery Package 2024 - Gleda Mellicent - Source aileyqmarigold.pages.dev

Dolar En Chile: Exchange Rates, Forecasts, And Economic Impact

The Chilean peso (CLP) is the official currency of Chile. It is issued by the Central Bank of Chile and is divided into 100 centavos. The CLP is the most traded currency in Chile and is used for all domestic transactions. The value of the CLP is determined by a number of factors, including the country's economic growth, inflation rate, and interest rates.

Precio del dolar en Chile cambio a pesos chilenos hoy - Source blog.espol.edu.ec

The CLP has been relatively stable in recent years, but it has experienced some volatility in the past. In 2013, the CLP lost about 10% of its value against the US dollar. This was due in part to the country's slowing economic growth and the Federal Reserve's decision to taper its quantitative easing program. The CLP has since recovered some of its losses, but it is still trading below its pre-2013 levels.

The future of the CLP is uncertain. The Chilean economy is expected to grow in the coming years, which could lead to an appreciation of the CLP. However, the CLP could also be affected by global economic conditions, such as the US-China trade war.

| Year | CLP/USD Exchange Rate | Change from Previous Year |

|---|---|---|

| 2013 | 680.00 | -10.00% |

| 2014 | 610.00 | -10.29% |

| 2015 | 620.00 | 1.64% |

| 2016 | 650.00 | 4.84% |

| 2017 | 630.00 | -3.08% |

| 2018 | 640.00 | 1.59% |

| 2019 | 650.00 | 1.56% |

| 2020 | 700.00 | 7.69% |

| 2021 | 750.00 | 7.14% |

| 2022 | 800.00 | 6.67% |

Conclusion

The exchange rate between the Chilean peso and the US dollar is an important indicator of the Chilean economy. A strong peso indicates a healthy economy, while a weak peso indicates a struggling economy. The CLP has been relatively stable in recent years, but it has experienced some volatility in the past. The future of the CLP is uncertain, but it is expected to be affected by the country's economic growth, inflation rate, and interest rates.

The Chilean economy is expected to grow in the coming years, which could lead to an appreciation of the CLP. However, the CLP could also be affected by global economic conditions, such as the US-China trade war.

Edith Stehfest: A Journey Of Success From "Gute Zeiten, Schlechte Zeiten" To Inspiring Author, John Batman: Founder Of Melbourne And Pioneer Of Australian Exploration, Unveiling The Year Of The Dragon: A Comprehensive Guide To Chinese New Year 2025, Timberwolves Vs. Nuggets: Denver Aims For Payback In Fierce Western Clash, Team Stock: Empowering Employees With Equity Ownership For Success, Jetstar Returns: Free Flights For A Limited Time, Vicente Taborda: Engineering Expertise For Sustainable Mining Solutions, Nuevo Aumento Para Empleadas Domésticas: Impacto En El Empleo Y La Economía, Racing Vs. Belgrano: Thrilling Football Clash In Buenos Aires, Monaco Vs. Inter Milan: A Clash Of The Titans In The Champions League,