Identify And Manage Duplicate Visa Charges: A Comprehensive Guide For Consumers

Got hit with duplicate Visa charges? You aren't alone! Visa is one of the most popular credit card networks globally, so it's no surprise that duplicate charges are a common problem. If you've recently noticed unauthorized or duplicate charges on your Visa statement, don't panic! There are steps you can take to identify if the charges are duplicate, how to get your money back, and how to prevent it from happening again.

Editor's Note: With the increase in online shopping, fraudulent activities and errors, "Identify And Manage Duplicate Visa Charges: A Comprehensive Guide For Consumers" is published today to help consumers who come across or fall victim of duplicate Visa charges.

Our team of experts has analyzed, dug into information, and put together this "Identify And Manage Duplicate Visa Charges: A Comprehensive Guide For Consumers" to help you make the right decision.

Key differences or Key takeaways:

Transition to main article topics:

FAQ

This section addresses common questions and concerns regarding duplicate Visa charges. The information provided is intended to empower consumers with knowledge and strategies for managing these situations effectively.

How to Effectively Identify and Manage Your Digital Assets: A - Source www.secondsight.ai

Question 1: What is a duplicate Visa charge?

A duplicate Visa charge occurs when a consumer is billed twice for the same transaction. This can happen due to errors during transaction processing or fraudulent activities.

Question 2: What are the causes of duplicate Visa charges?

Duplicate Visa charges can result from system errors, merchant errors, technical glitches, or unauthorized transactions.

Question 3: How can I identify duplicate Visa charges?

Reviewing bank statements regularly and comparing them with receipts can help identify duplicate charges. Additionally, Visa provides transaction alerts and online account access for monitoring charges.

Question 4: What should I do if I find a duplicate Visa charge?

Upon identifying a duplicate charge, it is crucial to contact the merchant to inquire about the error. If the merchant cannot resolve the issue, contact Visa and provide supporting documentation.

Question 5: Can I get a refund for duplicate Visa charges?

Yes, consumers are entitled to refunds for duplicate Visa charges. Visa has policies and procedures in place to protect consumers from unauthorized and erroneous transactions.

Question 6: How can I prevent duplicate Visa charges?

Using secure payment methods, monitoring account activity, and being cautious about providing card information online can help minimize the risk of duplicate charges.

By understanding the nature and causes of duplicate Visa charges, as well as the mechanisms available to address them, consumers can effectively manage these situations and safeguard their financial well-being.

Proceed to the next article section to learn more about Visa's dispute resolution process.

Tips

To effectively manage duplicate Visa charges, consider the following valuable tips:

Tip 1: Review credit card statements diligently

Scrutinize your Visa statements for any unfamiliar or duplicate transactions. Promptly report any discrepancies to your card issuer.

Tip 2: Contact the merchant directly

If you suspect a duplicate charge from a specific merchant, reach out to them directly. Explain the situation and request a refund or cancellation.

Tip 3: Utilize Visa's dispute process

If you are unable to resolve the issue with the merchant, file a dispute with Visa. Identify And Manage Duplicate Visa Charges: A Comprehensive Guide For Consumers provides detailed instructions on initiating the dispute process.

Tip 4: Monitor your credit report

Regularly review your credit report for any unauthorized activity or duplicate charges. Report any suspicious transactions to the credit bureau.

Tip 5: Contact your bank or credit union

If you have concerns about duplicate Visa charges, contact your bank or credit union. They may be able to assist with the dispute process or provide additional support.

By following these tips, you can effectively identify and manage duplicate Visa charges, ensuring the protection of your financial well-being.

Identify And Manage Duplicate Visa Charges: A Comprehensive Guide For Consumers

Duplicate visa charges can be frustrating and costly for consumers. This guide provides a comprehensive overview of how to identify and manage these charges, ensuring consumers' financial well-being.

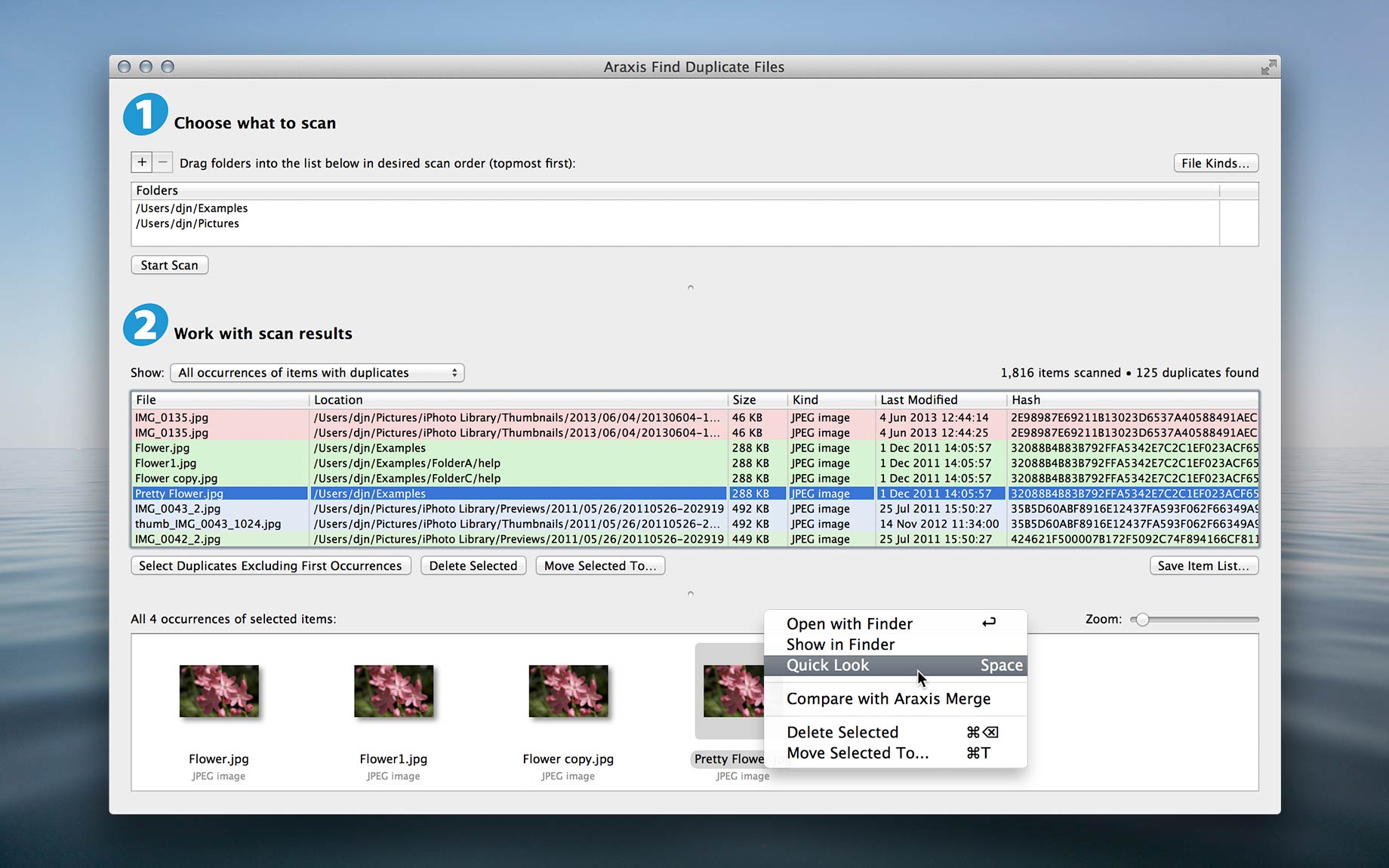

Araxis Find Duplicate Files – Find and manage files with duplicate - Source www.araxis.com

- Recognizing the Charges: Identify unauthorized or duplicate charges on credit card statements.

- Contacting the Merchant: Reach out to the merchant directly to resolve the issue swiftly.

- Reporting to Visa: Inform Visa about the duplicate charges for prompt assistance and protection.

- Filing a Dispute: Formally dispute the charges with your credit card company to initiate an investigation.

- Monitoring Transactions: Regularly review credit card statements to detect any potential duplicate charges.

- Preventing Future Occurrences: Utilize Visa's fraud prevention tools and enable security features to minimize vulnerabilities.

Understanding these aspects empowers consumers to safeguard their financial interests. By promptly identifying and addressing duplicate visa charges, consumers can effectively manage their finances and prevent unauthorized transactions, ensuring peace of mind and financial stability.

Redbox And Visa Team Up To Offer Consumers A Chance To Win 0 - Source www.prnewswire.com

Identify And Manage Duplicate Visa Charges: A Comprehensive Guide For Consumers

Recognising and managing fraudulent or duplicate Visa charges is critical for consumers' financial security. This guide explores the causes, importance, and practical steps to prevent and resolve such situations.

Dubai Visa - Singapore - Source www.dubaivisa.sg

Identifying duplicate charges requires vigilance and regular account monitoring. Checking statements for unauthorised transactions and keeping receipts for purchases helps detect irregularities. If a duplicate charge is identified, immediate action is essential to minimise financial loss.

Disputing the charge with the card issuer is the first step. This triggers an investigation and potentially a refund. Consumers should gather evidence such as receipts and statements to support their claim.

Preventing duplicate charges involves proactive measures such as using secure payment methods, checking for website authenticity, and enabling fraud alerts.

By understanding the causes, importance, and practical steps, consumers can effectively manage duplicate Visa charges, protecting their financial well-being.

| Cause | Prevention | Resolution |

|---|---|---|

| Hacked accounts | Strong passwords, two-factor authentication | Contact bank, freeze account, dispute charges |

| Card cloning | Chip-and-PIN cards, contactless payment limits | Contact bank, cancel card, report fraud |

| Merchant errors | Keep receipts, check statements regularly | Contact merchant, dispute charges with card issuer |

Conclusion

Understanding how to identify and manage duplicate Visa charges empowers consumers to safeguard their financial assets. By taking proactive measures, disputing unauthorised charges promptly, and cooperating with financial institutions, individuals can effectively protect themselves from fraudulent practices.

Financial literacy is crucial to avoid becoming a victim of duplicate charges. Staying informed about potential risks and being vigilant in monitoring transactions is essential for financial well-being.

Borussia Dortmund Vs. Shakhtar Donetsk: Clash Of The Titans In Champions League, Al-Nassr Vs Al Fateh: Saudi Pro League Clash For Supremacy, Fireworks Extravaganza Illuminates The Sydney Harbour For Australia Day 2025, LaLiga Matchday 17: Barcelona Vs. Valencia - A Clash Of Titans, Pronóstico Tucumán: El Norte Argentino Con Encanto Y Tradición, Chile Sub-20 Battles Uruguay Sub-20 In Intense South American Showdown, Rosario Central Draws With Lanús In Closely Contested Argentine Primera División Match, Tottenham Dominate Elfsborg In Pre-Season Friendly, Sporting Vs. Nacional: Primeira Liga Clash Of Titans, Tottenham Hotspur Vs. Elfsborg: Europa Conference League Clash,