Team Stock: Empowering Employees With Equity Ownership For Success

Editor's Note: Published August 30, 2023 - In today's competitive business landscape, companies are constantly seeking strategies to motivate and retain top talent. Team Stock: Empowering Employees With Equity Ownership For Success has emerged as a powerful tool, transforming the relationship between employers and employees.

After conducting extensive research and analysis, our team has compiled this comprehensive guide on Team Stock: Empowering Employees With Equity Ownership For Success, providing essential insights and practical guidance to support your decision-making.

Key Takeaways:

| Team Stock | Traditional Stock Options | |

|---|---|---|

| Ownership Structure | Equitable distribution among all employees | Restricted to key executives and upper management |

| Alignment of Interests | Creates shared ownership and responsibility | May not align incentives with all employees |

| Employee Motivation | Empowers employees with a stake in the company's success | Can be perceived as a reward rather than a shared ownership |

| Tax Implications | Favorable tax treatment for employees | May involve complex tax calculations |

Transition to main article topics:

FAQ

This section addresses frequently asked questions concerning equity ownership for employees as a means of empowering them and promoting success within an organization.

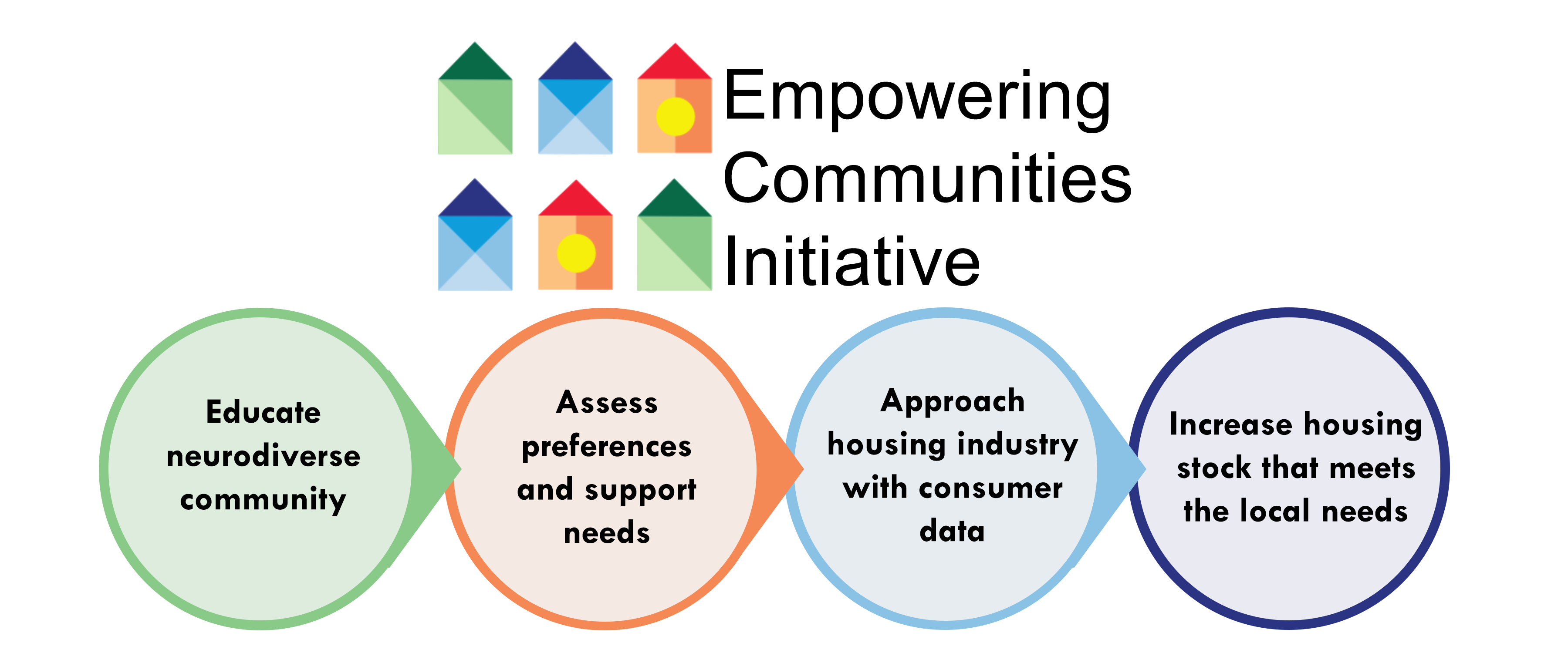

Empowering Communities Initiative – Inclusive Housing Denver - Source inclusivehousingdenver.org

Question 1: What are the primary benefits of offering employee equity ownership?

Equity ownership aligns the interests of employees with those of the company, fostering a sense of ownership and shared purpose. By providing employees with a stake in the company's success, it encourages them to contribute more actively to its growth, leading to improved performance and innovation.

Question 2: How does employee equity ownership impact motivation and engagement?

When employees possess a financial stake in the company, they are more likely to be motivated to make valuable contributions. The prospect of future financial rewards encourages them to go above and beyond their regular responsibilities, fostering a culture of high performance and engagement.

Question 3: What are potential drawbacks of introducing employee equity ownership?

One potential drawback is the dilution of ownership for existing shareholders. Additionally, if the company's performance declines, employees may experience financial losses. It is crucial to carefully consider these factors and implement a well-structured equity ownership plan to mitigate potential risks.

Question 4: How can companies ensure employees understand the complexities of equity ownership?

Providing clear and comprehensive education to employees is essential. Companies should conduct training sessions, distribute educational materials, and offer opportunities for employees to seek clarification from designated experts. This ensures employees fully grasp the terms, risks, and potential benefits associated with equity ownership.

Question 5: What legal and regulatory considerations must companies adhere to when implementing employee equity ownership?

There are various legal and regulatory requirements that companies must meet when offering equity ownership to employees. These may include compliance with securities laws, tax regulations, and corporate governance guidelines. Failure to comply with these regulations can result in penalties or other adverse consequences.

Question 6: How can companies leverage employee equity ownership to attract and retain top talent?

Equity ownership can serve as a powerful tool for attracting and retaining top talent. By offering equity as part of compensation packages, companies can demonstrate their commitment to employee growth and success. It also signals a desire to build a long-term relationship with valuable employees, fostering a sense of loyalty and dedication.

In summary, employee equity ownership offers numerous benefits, including increased motivation, enhanced engagement, and the potential to attract and retain top talent. However, companies should carefully consider potential drawbacks, ensure employees fully understand the terms, and adhere to legal and regulatory requirements. By implementing a well-structured equity ownership plan, organizations can empower employees and foster a culture of success and shared purpose.

Stay tuned for additional insights on how employee equity ownership can transform workplaces and drive organizational success.

Tips

Equity ownership empowers employees with a shared stake in the company's success. Follow these tips to foster employee engagement and drive company growth:

Tip 1: Determine Eligibility Criteria

Establish clear guidelines for employee eligibility based on factors such as job level, tenure, or performance. This ensures fairness and aligns equity ownership with company goals.

Tip 2: Communicate the Program Effectively

Explain the equity ownership program to employees transparently, emphasizing the benefits and responsibilities associated with it. Open communication fosters trust and engagement.

Tip 3: Offer a Range of Options

Provide employees with a variety of equity ownership options, such as stock options, restricted stock units, or profit sharing. This gives them flexibility to choose the option that best aligns with their risk tolerance and financial goals.

Tip 4: Vest Ownership Over Time

Vesting helps retain employees and aligns their interests with the long-term success of the company. Structure vesting schedules to gradually transfer ownership over a period of years, incentivizing employee commitment.

Tip 5: Provide Education and Support

Equip employees with the knowledge and tools they need to understand their equity ownership. Offer financial literacy workshops and make resources available to help them make informed decisions about managing their equity.

Summary: By implementing these tips, companies can create an equity ownership program that empowers employees, fosters a sense of ownership, and drives innovation and growth.

Team Stock: Empowering Employees With Equity Ownership For Success provides additional insights into the benefits of employee equity ownership and strategies for successful implementation.

Team Stock: Empowering Employees With Equity Ownership For Success

Equity ownership for employees, also referred to as team stock, has emerged as a powerful strategy that bestows employees with ownership stakes within their organizations. This ownership incentivizes employees to work towards the success of the company and ultimately augments their sense of purpose and autonomy. Here are some essential aspects that contribute to the effectiveness of team stock programs:

- Ownership Mindset: Employees with equity stakes develop an owner-like mindset, driving them to act with the company's best interests in mind.

- Alignment of Goals: Team stock aligns employee goals with the company's strategic objectives, fostering a sense of shared purpose and commitment.

- Performance Incentives: Equity ownership acts as a performance incentive, motivating employees to go above and beyond in their roles.

- Talent Retention: Team stock programs can be an effective tool for retaining top talent, reducing employee turnover.

- Company Valuation: Equity ownership contributes to the valuation of a company, enhancing its attractiveness to investors and potential acquirers.

- Tax Implications: It's important to consider the tax implications of team stock programs, ensuring compliance with applicable regulations.

Team stock programs can take different forms, including stock options, restricted stock, and employee stock purchase plans. The specific structure depends on the company's size, stage, and financial situation. By implementing team stock programs thoughtfully, organizations can reap the benefits of engaged and motivated employees while fostering a culture of ownership and success.

Empower Empowering Empowerment Improvement Concept Stock Photo - Image - Source www.dreamstime.com

Team Stock: Empowering Employees With Equity Ownership For Success

Team stock, or employee stock ownership plans (ESOPs), are a powerful tool for empowering employees and driving business success. By providing employees with a stake in the company's ownership, ESOPs create a shared sense of purpose and align employee interests with those of the organization. This leads to increased productivity, innovation, and employee retention.

Empowering Employees Quotes. QuotesGram - Source quotesgram.com

One of the most important benefits of ESOPs is that they foster a sense of ownership and responsibility among employees. When employees know that they have a financial stake in the success of the company, they are more likely to go the extra mile and contribute to its growth. This can lead to a more engaged and motivated workforce, which is essential for driving innovation and productivity.

ESOPs can also help to create a more equitable distribution of wealth. In many companies, the majority of the ownership is concentrated in the hands of a few shareholders. ESOPs can help to distribute ownership more broadly, giving employees a stake in the company's success and helping to create a more just and equitable workplace.

There are many practical applications for ESOPs. They can be used to attract and retain employees, reward performance, and provide retirement benefits. ESOPs can also be used to finance business growth and expansion.

ESOPs are a powerful tool that can be used to empower employees and drive business success. By providing employees with a stake in the company's ownership, ESOPs create a shared sense of purpose and align employee interests with those of the organization. This leads to increased productivity, innovation, and employee retention.

| Benefit | Description |

|---|---|

| Increased productivity | Employees have a vested interest in the company's success and are more likely to go the extra mile. |

| Increased innovation | Employees are more likely to share their ideas and take risks when they know they have a stake in the company's success. |

| Increased employee retention | Employees are more likely to stay with a company that they feel invested in. |

| More equitable distribution of wealth | ESOPs can help to distribute ownership more broadly, giving employees a stake in the company's success and helping to create a more just and equitable workplace. |

| Attracting and retaining employees | ESOPs can be used to attract and retain top talent. |

| Rewarding performance | ESOPs can be used to reward employees for their contributions to the company's success. |

| Providing retirement benefits | ESOPs can be used to provide employees with a retirement nest egg. |

| Financing business growth and expansion | ESOPs can be used to raise capital for business growth and expansion. |

Conclusion

Team stock is a powerful tool that can be used to empower employees and drive business success. By providing employees with a stake in the company's ownership, ESOPs create a shared sense of purpose and align employee interests with those of the organization. This leads to increased productivity, innovation, and employee retention.

ESOPs are a unique and valuable employee benefit that can help companies to achieve their strategic goals. If you are considering implementing an ESOP, we encourage you to do your research and talk to an expert to learn more about the benefits and challenges of ESOPs.

Dinamo Zagreb Vs. AC Milan: Champions League Showdown, Josh Frydenberg: Treasurer Of Australia And Economic Navigator, The Ultimate Guide To The 2023 BBL Final: Teams, Matchups, And Predictions, Veronica "Vero" Marina Olsen: International EDM Superstar And Trailblazing DJ, Bishop Mariann Edgar Budde: Pioneering LGBTQ+ Advocate And Episcopal Leader, Torneo Argentino: Argentina's Thrilling Domestic Football Competition, San Lorenzo Hoy: Últimas Noticias, Deportes, Política Y Más Sobre El Club Atlético San Lorenzo De Almagro, Estudiantes Vs. Unión: Un Duelo Por La Cima En El Fútbol Argentino, PSG Vs. Stuttgart: Champions League Group Stage Clash, Rb Leipzig Seek Redemption Against Leverkusen In Bundesliga Clash,