Unlock Financial Stability With Our High-Yield Fixed Deposit Solution

Wondering how to unlock financial stability?

Introducing Our High-Yield Fixed Deposit Solution!

Editor's Note: "Unlock Financial Stability With Our High-Yield Fixed Deposit Solution" has published today, 14th May, 2023. This topic is important, especially nowadays, with current inflation rate 2023, people have concern about their saving diminishing. If you are looking for a safe and secure way to grow your money, our high-yield fixed deposit solution is the perfect choice for you.

After doing some analysis, digging information, and combine with our experiences, we put together this Unlock Financial Stability With Our High-Yield Fixed Deposit Solution guide to help you make the right decision.

| Key Differences | Key Takeaways | |

|---|---|---|

| Investment Amount | Minimum investment amount is low, making it accessible to a wide range of investors. | |

| Interest Rates | Offers competitive interest rates, higher than traditional savings accounts. | |

| Tenure Options | Flexible tenure options are available, allowing you to choose a term that suits your financial goals. | |

| Safety and Security | Your deposits are protected by government insurance, ensuring the safety of your investment. |

Financial Stability 3D Illustration 27156007 PNG - Source www.vecteezy.com

Here's why our high-yield fixed deposit solution is the right choice for you:

FAQs

Gaining a comprehensive understanding of our high-yield fixed deposit solution is essential for maximizing its benefits. This FAQ section addresses frequently encountered questions to clarify any misconceptions and provide valuable insights for potential investors.

Question 1: What are the factors that determine the high yield offered by this fixed deposit solution?

The yield is meticulously calculated based on a comprehensive analysis of the prevailing market conditions, economic indicators, and our robust financial management strategies. By leveraging our expertise and optimizing resource allocation, we can offer competitive returns while ensuring the security of your investment.

Question 2: Is the high yield guaranteed throughout the fixed deposit term?

While we endeavor to maintain a stable high yield, it is essential to note that interest rates are subject to market fluctuations. However, our commitment to prudent financial management and continuous monitoring of economic trends allows us to offer a highly competitive and consistent yield within the constraints of market dynamics.

Question 3: How can I access my funds before the fixed deposit maturity date?

Premature withdrawals are generally not permitted for fixed deposits to preserve the integrity of the investment term and ensure optimal returns. However, we understand that unforeseen circumstances may arise. In such cases, we offer flexible options that may include partial withdrawals or early termination, subject to applicable terms and conditions.

Question 4: Are there any hidden charges or fees associated with this fixed deposit solution?

Transparency is paramount to us. There are no hidden charges or fees involved in opening or maintaining this high-yield fixed deposit account. Our terms and conditions are clearly outlined, ensuring that you are fully informed of all applicable charges, if any, before committing to the investment.

Question 5: How is the interest calculated and paid out?

Interest accrues daily and is compounded periodically, maximizing your earnings over the fixed deposit term. The interest earned can be credited to your account or reinvested to further enhance your returns, depending on your preference.

Question 6: What is the minimum investment amount required to avail the high-yield fixed deposit solution?

We have designed this solution to be accessible to a wide range of investors. The minimum investment amount is set at a reasonable level, allowing you to participate and benefit from the high-yield returns, even with modest capital.

These FAQs provide a comprehensive overview of our high-yield fixed deposit solution. We encourage you to seek professional financial advice if you have any further questions or require personalized guidance to determine if this investment aligns with your financial goals.

The Uplifting Signs of Financial Stability You Need to Know – phroogal - Source www.phroogal.com

Explore the next article section for additional insights and valuable investment strategies.

Unlock Financial Stability With Our High-Yield Fixed Deposit Solution

Enhance your financial future with our high-yield fixed deposit solution, designed to provide a secure and rewarding investment experience. Explore these tips to maximize your returns and achieve financial stability.

Tip 1: Choose a reputable financial institution.

Selecting a trusted financial institution is crucial for ensuring the safety and reliability of your investment. Research the institution's financial stability, customer service, and industry reputation to make an informed decision.

Tip 2: Determine your investment goals.

Clearly define your financial objectives before investing. Whether it's accumulating wealth for retirement, funding a major purchase, or generating a steady income stream, understanding your goals will guide your investment strategy.

Tip 3: Consider the tenure and interest rate.

Fixed deposits offer varying tenure options and interest rates. Choose a tenure that aligns with your financial needs and goals. Higher interest rates typically come with longer tenures, but also consider the opportunity cost of locking in your funds for an extended period.

Tip 4: Compare different fixed deposit options.

Research and compare multiple fixed deposit offerings from different financial institutions. Evaluate the interest rates, tenures, and any additional features or benefits they provide to make an informed choice.

Tip 5: Monitor your investment regularly.

Once you've invested, it's essential to monitor your fixed deposit's performance regularly. Track interest accrual, market fluctuations, and any changes in the financial institution's status to ensure your investment remains on track.

Unlock your financial stability with our high-yield fixed deposit solution today. Maximize your returns and secure your financial future with these valuable tips.

Unlock Financial Stability With Our High-Yield Fixed Deposit Solution

Fortified by high yields, fixed deposit solutions establish a bedrock foundation for your financial stability.

- Assured Returns: Guarantee steadfast growth of investments.

- Tailored Tenors: Flexibility to align investments with financial goals.

- Steady Interest Flow: Predictable returns ensuring consistent cash flow.

- Risk Mitigation: Safeguard capital against market volatility.

- Tax Optimization: Leverage tax-saving options for savvy returns.

- Expert Guidance: Dedicated advisors for personalized financial planning.

These key aspects coalesce to create an unparalleled financial stability solution. Assured returns provide a predictable foundation, while tailored tenors and steady interest flow enable strategic financial planning. Risk mitigation safeguards against uncertainties, and tax optimization maximizes returns. Expert guidance empowers informed decision-making, ensuring your financial journey aligns seamlessly with your aspirations.

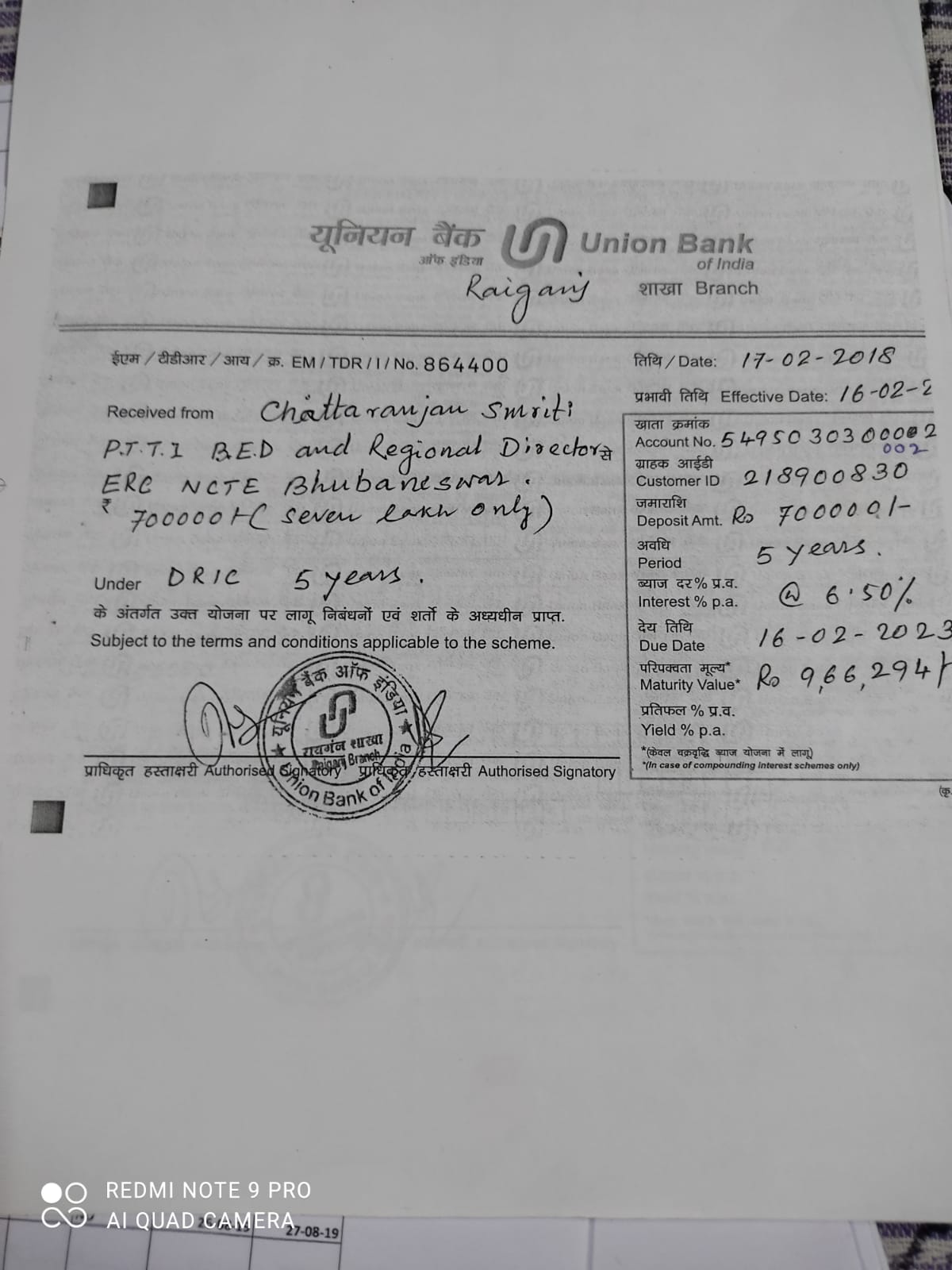

Fixed deposit receipt – Chittaranjan Smriti Primary Teacher’s Training - Source www.csptti.org.in

Unlock Financial Stability With Our High-Yield Fixed Deposit Solution

Achieving financial stability is a crucial aspect of long-term financial well-being. One of the key pillars of financial stability is a savings plan that offers consistent returns. In this context, a high-yield fixed deposit (FD) solution emerges as an attractive option for investors seeking a combination of safety, stability, and growth for their savings.

KTDFC Fixed Deposit Scheme - Source apnaplan.com

A high-yield FD offers several advantages that contribute to financial stability. Firstly, it provides a consistent and predictable return on investment. Unlike market-linked investments, FDs offer a fixed rate of interest, ensuring a stable flow of income that can be relied upon for financial planning. This predictability allows individuals to accurately budget and plan for their financial goals, such as retirement, child's education, or a down payment on a house.

Secondly, FDs are considered a low-risk investment option. They are backed by the FDIC, which insures deposits up to a certain amount, providing an added layer of security for investors. This makes FDs suitable for individuals with a low risk tolerance or those who prioritize preserving their capital.

Moreover, FDs offer flexibility in terms of tenor and interest payout options. Investors can choose a term that aligns with their financial goals and select whether they want the interest to be paid out periodically or reinvested to earn compound interest. This flexibility allows investors to customize their FD investment to meet their specific financial needs and requirements.

Overall, a high-yield FD solution plays a significant role in unlocking financial stability. It offers a steady and predictable return, minimizes investment risk, and provides flexibility in terms of tenor and payout options. By incorporating a high-yield FD into their financial portfolio, individuals can establish a solid foundation for their long-term financial well-being.

Ajax Vs. Galatasaray: UEFA Champions League Matchup Preview, Battle Of The Titans: Bucks Clash With Jazz In NBA Playoff Thrill Ride, Marvel's Friendly Neighborhood Spider-Man: Uniting Community Through Heroism, The Rise Of Australian Cricket: A Dynasty Forged In Triumph And Resilience, Napoli Vs. Juventus: A Clash Of Italian Giants, Tottenham Hotspur Vs. Leicester City: Premier League Clash Of Titans, Latin Music Icon Amalia Gonzalez: Pioneer, Vocalist, And Cultural Legacy, When Is The Anses Bono AUH Payment For February 2025?, Al-Ahli Saudi Vs Al-Riyadh: Saudi Pro League Clash Of Titans, Girona Vs. Arsenal: Gunners Aim To Secure Europa League Quarterfinal Berth,